Some Of Clark Wealth Partners

Wiki Article

Getting The Clark Wealth Partners To Work

Table of ContentsGetting The Clark Wealth Partners To WorkThe Ultimate Guide To Clark Wealth PartnersExcitement About Clark Wealth PartnersThe 3-Minute Rule for Clark Wealth PartnersExcitement About Clark Wealth PartnersExamine This Report on Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.The Best Strategy To Use For Clark Wealth Partners

Usual factors to think about a financial advisor are: If your economic scenario has actually come to be more complicated, or you lack confidence in your money-managing skills. Conserving or browsing significant life occasions like marriage, divorce, youngsters, inheritance, or job modification that might substantially influence your financial circumstance. Navigating the change from saving for retired life to protecting wealth throughout retirement and just how to produce a strong retirement revenue plan.New technology has actually led to even more comprehensive automated monetary devices, like robo-advisors. It depends on you to examine and figure out the appropriate fit - https://businesslistingplus.com/profile/blanca-rush/. Inevitably, a good economic consultant ought to be as mindful of your investments as they are with their very own, preventing excessive costs, saving money on tax obligations, and being as transparent as feasible concerning your gains and losses

The Ultimate Guide To Clark Wealth Partners

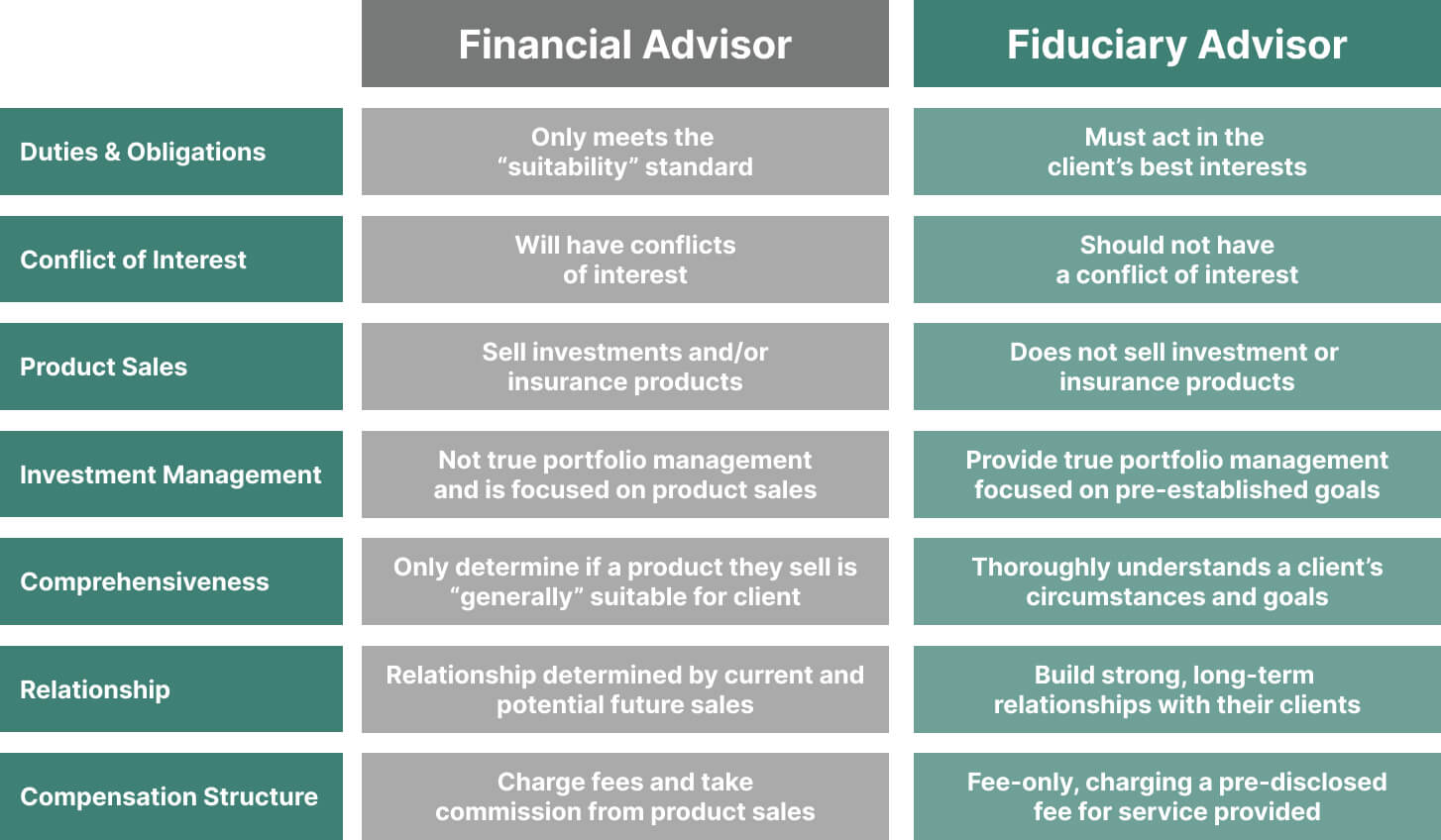

Making a compensation on item referrals does not always mean your fee-based consultant functions against your ideal passions. However they might be much more inclined to suggest product or services on which they make a compensation, which might or might not remain in your benefit. A fiduciary is legally bound to place their customer's interests first.This conventional enables them to make suggestions for investments and services as long as they match their customer's goals, danger tolerance, and financial scenario. On the other hand, fiduciary advisors are lawfully bound to act in their client's ideal passion rather than their very own.

Clark Wealth Partners Can Be Fun For Everyone

ExperienceTessa reported on all points spending deep-diving into complex monetary subjects, clarifying lesser-known financial investment avenues, and uncovering means readers can function the system to their advantage. As a personal money specialist in her 20s, Tessa is acutely aware of the influences time and unpredictability have on your investment decisions.

It was a targeted promotion, and it worked. Find out more Review much less.

The Buzz on Clark Wealth Partners

There's no solitary path to coming to be one, with some individuals starting in financial or insurance policy, while others start in accounting. 1Most financial planners start with a bachelor's degree in finance, business economics, audit, company, or a related subject. A four-year level provides a strong structure for careers in financial investments, budgeting, and customer solutions.

4 Easy Facts About Clark Wealth Partners Shown

Common instances consist of the FINRA Collection 7 and Collection 65 tests for safeties, or a state-issued insurance coverage license for offering life or health insurance policy. While credentials may not be legitimately required for all preparing functions, employers and clients usually see them as a standard of professionalism and reliability. We check out optional qualifications in the following area.Many economic coordinators have 1-3 years of experience and knowledge with monetary products, conformity standards, and direct client communication. A solid educational history is crucial, yet experience demonstrates the ability to apply concept in real-world setups. Some programs integrate both, allowing you to complete coursework while making supervised hours with teaching fellowships and practicums.

The Only Guide for Clark Wealth Partners

Numerous go into the area after functioning in banking, accountancy, or insurance coverage, and the change requires persistence, networking, and usually advanced credentials. Very early years can bring lengthy hours, stress to develop a customer base, and the demand to constantly confirm your competence. Still, the career uses strong long-lasting potential. Financial coordinators take pleasure in the opportunity to work closely with customers, overview important life decisions, and usually accomplish versatility in schedules or self-employment.

Wide range managers can boost their earnings with compensations, possession charges, and efficiency benefits. Monetary managers manage a group of monetary planners and consultants, establishing department method, taking care of conformity, budgeting, and directing inner procedures. They invested much less time on the client-facing side of the industry. Nearly all financial supervisors hold a bachelor's degree, and several have an MBA or comparable academic degree.

The Ultimate Guide To Clark Wealth Partners

Optional certifications, such as the CFP, normally call for extra coursework and screening, which can extend the timeline by a pair of years. According to the Bureau of Labor Data, individual monetary advisors gain a median yearly annual salary of $102,140, with leading earners gaining over $239,000.In various other districts, there are laws that need them to satisfy specific requirements to use the economic advisor or economic planner titles. For economic organizers, there are 3 common classifications: Certified, Personal and Registered Financial Organizer.

5 Easy Facts About Clark Wealth Partners Explained

Where to locate a monetary consultant will depend on the kind of suggestions you need. These establishments have staff that may assist you comprehend and buy certain types of investments.Report this wiki page